Excitement About Forex Spread Betting

Wiki Article

The Ultimate Guide To Forex Spread Betting

Table of ContentsForex Spread Betting Fundamentals ExplainedExcitement About Forex Spread BettingUnknown Facts About Forex Spread BettingThings about Forex Spread Betting

This is just how much you can make or lose on a spread bet for every single point of movement in the price of the marketplace. It is also understood as the risk size. This refers to the closure of a setting, as well as the outcome establishes whether you have actually earned a profit or a loss.

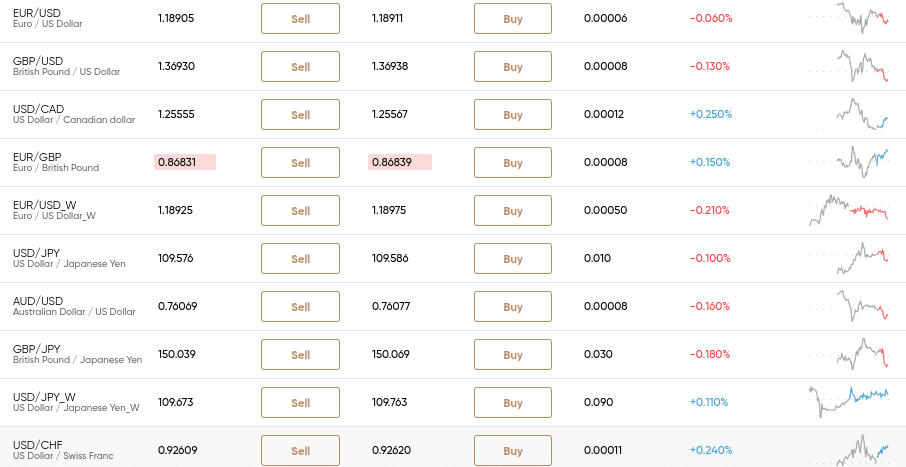

throughout bouts of severe volatility, when rates move greatly up or down. The spread is the difference between the 2 estimate on every spread bet: the deal cost for the same property. Frequently shortened to DFB, this term describes a placement that continues to be open until you determine to close it.

Forex Spread Betting Things To Know Before You Get This

If you believe an asset is going to rise in price, you can purchase a placement because possession through a spread bet. This is called going long. By comparison, if you think the cost is mosting likely to fall, you can sell the spread bet. This is called going short.

A margin phone call is made when the equity in your account the overall funding you have actually deposited plus or minus any type of earnings or losses goes down listed below the minimum need. If this is the instance, there is a risk that the broker will immediately close your settings, possibly leaving you with losses.

The spread is the difference in between a broker's sell and also acquire (bid as well as deal) rates. This is how the broker makes its revenue. The hidden possession's value will remain in the center of these two rates. As an example, if the FTSE 100 index is at 7100, a spread-betting company may price estimate a spread of 70997101.

All about Forex Spread Betting

As a whole, the smaller sized the spread the better, as you need the price to relocate less in your instructions prior to you begin making a revenue. There are a number of spread-betting methods that can be deployed. Check out for even more information on strategies and also a vast array of additional academic product.Arbitrage entails the synchronised purchase as well as sale of the very same property in various markets in order to benefit from little differences in the rate. Spread betters do this when brief term actions by purchasers and sellers at a certain broker vary from those at one more, resulting in various costs (forex spread betting). While the quotes listed on broker sites reflect the hidden rate movements in the tools they are based on, they are not constantly identical.

This technique involves trading based upon news as well as market assumptions, both previously and also complying with press release. You will certainly have to act rapidly as well as have the ability to make a quick reasoning on exactly how to trade a brand-new announcement or item of data. You will certainly likewise need to be able to judge whether the news is currently factored into the supply cost as well as whether the news matches financier expectations.

The negative aspect is that you need significant expertise in exactly how markets run and also just how to analyze information and news - forex spread betting. According to the broker CMC discover here Markets, this style of trading requires less time dedication than various other trading strategies because there is only a requirement to research charts at their opening and closing times.

The Forex Spread Betting Statements

The technique concentrates on his comment is here studying the existing day's rate contrasted with the previous day's price movements, and also making use of that as a guide to just how the market is likely to relocate - forex spread betting. Investors can use different devices to restrict their over night danger, such as establishing a take-profit order or a stop-loss limit.They depend on signs to determine when a trend is taking hold and also after that trade on the basis that that trend will certainly proceed. Technical-analysis traders start by seeking to comprehend where the cost is heading according to the fundamentals of supply and also demand.

Likewise, in an uptrend, a line on the graph connecting previous highs will certainly serve as resistance when over the existing level, while a line attaching previous lows will serve as support with the reverse real in a falling market. Swing trading is a style of trading that focuses on short-term fads in a financial instrument over a duration of a few days to numerous weeks.

If see this page this is done constantly gradually, fairly small gains can intensify right into exceptional yearly returns. Swing investors ought to concentrate on the most actively traded stocks that reveal a propensity to turn within wide, distinct limits. It's a great concept to concentrate on a choose team of economic tools, as well as check them daily, to make sure that you understand the cost action they normally show.

Report this wiki page